How To Change My Posb Atm Card To Debit Card

Privileges

Attractions and Entertainment

Enjoy 1-for-1 deals at the following places on the 10th day of every month. Click here to find out more.

- Cathay Cineplexes

- Klook (available from February 2021)

- Pororo Park Singapore

- Singapore Cable Car

- Adventure Cove Waterpark

- S.E.A. Aquarium

- Tayo Station

- The Polliwogs

Please note that these deals are temporarily unavailable until further notice.

- Gardens by the Bay

- Night Safari

- Jurong Bird Park

- River Safari

- Singapore Zoo

Limited redemptions available on the 10th day of every month. Click here for details.

Note: Please refer to each attraction's website for specific opening details.

Groceries

4% Rebates at Cold Storage, Marketplace, Jasons, Giant and Guardian

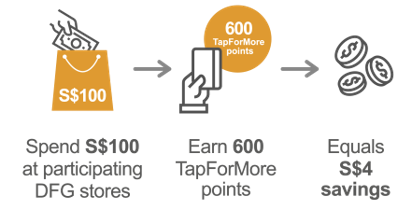

Enjoy 4% rebates (or 6x TapForMore points) for every dollar spent online or in-stores at participating Dairy Farm Group (DFG) stores – Cold Storage, Marketplace, Jasons, Giant and Guardian.

Valid with a minimum spend of S$400 on your PAssion POSB Debit Card anywhere in the same calendar month.

Every 150 TapForMore points allows you to offset S$1 off your next purchase.

You can also convert TapForMore points to KrisFlyer miles for award flights (1 TapForMore point = 0.43 miles) or STAR$® by CapitaStar for shopping vouchers (1 TapForMore point = 4 STAR$®). Click here for more information on using your TapForMore points.

Maximum of 7,500 TapForMore points can be earned per month. No minimum spend required for cardmembers aged 65 years and above. Click here for terms and conditions.

Shopping

Get 1% cashback at Takashimaya Department Store and Takashimaya Square, B2.

No minimum spend required. Click here for terms and conditions.

Travel

Enjoy up to 15% off your accommodation bookings on Agoda

Book now to enjoy:

- 15% off local accommodation

- 10% off worldwide accommodation

Valid for booking 31 Dec 2021 and stay till 30 June 2022.

Click here for more details on the promotion.

More Card Benefits

PAssion Membership Privileges

Enjoy free PAssion membership1 (worth S$12) which comes with these privileges:

- Member rates for all Community Club courses, activities and facilities, and privileges at other PA outlets (PAssion WaVe, Chingay Parade and more)

- Discounts at over 2,000 PAssion Merchant outlets

- Complimentary National Library Board Partner Membership which entitles you to borrow up to 24 library items2

- Redeem a $5 eCapitaVoucher3 at only 4,500 STAR$®

Under the all-new PAssion CARES initiative4, you can now earn TapForMore points at selected community events when you tap your PAssion POSB Debit Card at the PAssion CARES terminals located at these events. With every successful tap, you will receive 7.5 TapForMore points. POSB and Dairy Farm Singapore Group will contribute another 7.5 TapForMore points towards a good cause. Start doing your part for charity by tapping your card at these events!

1By activating the PAssion POSB Debit Card, you agree on becoming a PAssion Card member and so consent to the bank's sharing of relevant information with People's Association (PA), as required for the sole purpose of creating your PAssion Card membership. Membership will be processed within five working days from date of card activation.

2For Singaporeans and Singapore PRs only. Click here for terms and conditions.

3Download the CapitaStar App and activate your CapitaStar privileges. Offer limited to first 10,000 members monthly. Visit www.capitastar.com.sg for more information. Other terms and conditions apply.

4For more information on the PAssion CARES initiative, please log on to passioncard.gov.sg.

Click here for more information on PAssion membership.

Enjoy all the convenience in one card.

- Sign for point-of-sale and online transactions at Mastercard® accepting merchants worldwide

- Tap and go with Mastercard® contactless for purchases below S$200

- Pay for purchases at all NETS accepting merchants locally

- Withdraw cash overseas conveniently from ATMs with Mastercard or Cirrus logos

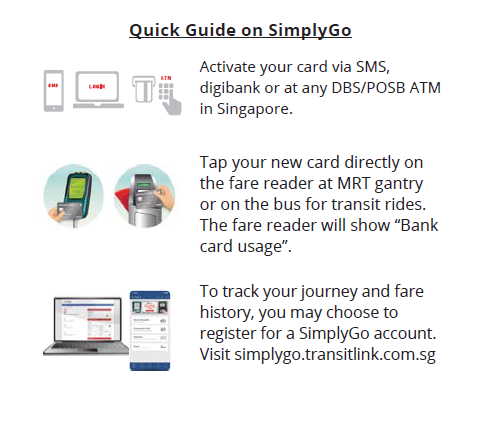

Tap and SimplyGo on buses and trains without having to top up

You can also access your travel history anytime and anywhere via the SimplyGo Portal or mobile app.

Click here for more information.

Promotions

Testing Information Text 2

Apply for Passion POSB Debit Card and get 10% Cashback on Dining and Groceries

To apply through your digibank mobile app:

Launch digibank app, login, select More > Apply > Cards.

*The PAssion POSB Debit Card is a debit card that doubles up as a PAssion card. In order to create your PAssion Card membership, the bank must share relevant personal information with People's Association (PA) that will be used for the sole purpose of creating your membership.

Effective 21 April 2017, the POSB GO!, POSB Active, POSB Multitude and DBS MoneySmart Debit Cards will be discontinued. Successful activation of your new PAssion POSB Debit Card will automatically terminate the mentioned card(s), if any, and the account linkages will be transferred to your new PAssion POSB Debit Card.

Eligibility & Fees

| Eligibility | At least 16 years old and have a POSB Savings Account, DBS Savings Plus Account, DBS Autosave Account or DBS Current Account. |

| Annual Fee | S$0 |

| PAssion Membership Fee | S$12 for 5-year membership (waived perpetually) |

Purchases are directly deducted from your bank account. There are potential risks of unauthorised signature-based, contactless or card-not-present transactions. Subject to the DBS Debit Card Agreement, the maximum liability for unauthorised transactions not due to your negligence is S$100. Please allow up to 14 days to process refunds. DBS Debit Card Agreement applies. For a copy of the DBS Debit Card Agreement, please visit here.

- Change ATM Card Limit

- Change Debit Card Spending Limit

- Overseas Withdrawal Charges

Click here for other Card Enquiries.

For more information, call 1800 339 6666 (Singapore) or +65 6339 6666 (Overseas).

More Info

Card Usage Limits

The default daily limits set on your NETS Transactions, ATM Withdrawals and Debit Card Spend Transactions are set at S$5000, S$3000 and S$2000 respectively.

To find out what are the current daily spend/NETS/withdrawal limits on your debit card and to revise these limits, you may do so via iBanking, under 'Cards > Change Debit Card Limit'.

Disabling Contactless transactions on your DBS/POSB Debit Card(s)

If you prefer to only use your Visa, MasterCard or UnionPay Debit card(s) for PIN-based NETS and ATM transactions and would like to disable the contactless feature, you may set your debit card limit to $0 via digibank Online or Mobile. Changing the limit for your Debit Card Spend Transactions will not affect your PIN-based NETS and ATM transactions.

Frequently Asked Questions

How does my Passion POSB Debit Card Work?

This PAssion POSB Debit Card can be used at ATMs and for PIN-based transactions at selected merchants in Singapore and at Maestro or Cirrus enabled merchants overseas. It also allows you to sign for local and overseas purchases and perform contactless payment via Mastercard® contactless, card-not-present transactions (such as online, mail and phone orders), which shall be paid for by directly deducting the transaction amount(s) from your bank account.

Your Mastercard Debit Limit for signature-based, Mastercard contactless and card-not-present transactions is set at S$2,000. A Debit Card carries risks of unauthorised signature-based, Mastercard contactless or card-not-present transactions. You may choose to increase/decrease this limit upon activation.

What are the daily spend/withdrawal limits on my PAssion Debit Card?

The default daily limits set on your NETS Transactions, ATM Withdrawals and Debit Card Spend Transactions are set at S$5000, S$3000 and S$2000 respectively.

To find out what are the current daily spend/NETS/withdrawal limits on your debit card and to revise these limits, you may do so via iBanking, under 'Cards > Change Debit Card Limit'.

Can I use my PAssion POSB Debit Card overseas?

If you have allowed the overseas use of magnetic stripe on your DBS/POSB Card(s), it is recommended that you set the magnetic stripe on your card(s) to disallow overseas use when you are in Singapore. With the magnetic stripe disabled for overseas use, the risk of unauthorised transactions being effected on the card will be reduced.

You may disallow overseas use of the magnetic stripe on your card(s) by sending the following SMS to 77767: Disable <space> overseas <space> card's last 4 digits. (For example: Disable overseas 1234, where 1234 is the last 4 digits of your card number). You may also disallow the magnetic stripe on your card(s) via iBanking/digibank or any DBS/POSB ATM in Singapore.

Visit www.dbs.com.sg/ms for more details.

How do I commute now that my EZ-Link CEPAS function is removed?

Effective 22 June 2020, all new, replacement and renewal cards issued will no longer have the CEPAS function for EZ-Link transactions. Commuters can now tap and SimplyGo on buses and trains without having to top up with their PAssion POSB Debit Cards.

What should I do if my Card is lost, stolen or if my PIN has been compromised?

Please notify us immediately by calling 1800 111 1111 (from Singapore) or +65 6327 2265 (International).

- Please make a police report and provide us with a copy of the report and in certain circumstances accompanied by written confirmation of the loss/ theft/ disclosure and any other information that we may require.

- Once we establish, with your assistance, that the loss or theft of your Card or PIN compromise was not due to your fault or negligence, your liability for unauthorised transactions effected after such loss, theft or unauthorised disclosure but before we are notified thereof shall be limited to S$100.

- You will not be liable for any transactions carried out after you have notified us.

- We will refund the amounts deducted from your bank account for unauthorised transactions, in excess of the applicable liability cap, within 14 working days from the time you submit all the necessary information to us.

- For EZ-Link refund enquries, please click here.

When will my PAssion membership be activated?

Your PAssion membership will be processed within 5 working days from date of card activation. Upon activation of your PAssion membership, you will be able to enjoy PAssion privileges such as the TapForMore Rewards Programme, National Library Board Partner Membership and discounts at Community Clubs.

Can I apply for a supplementary Card?

Supplementary Card is not applicable to the PAssion POSB Debit Card.

If I am currently an existing PAssion Cardholder, can I still apply for the PAssion POSB Debit Card?

Yes, you can. Your existing PAssion Card Membership will be terminated once your application for the PAssion POSB Debit Card is approved. A new lease of 5-years membership will commence with the PAssion POSB Debit Card.

Will the TapForMore Programme in my existing PAssion Card be transferred to the new PAssion POSB Debit Card?

Yes, it will be transferred within 5 working days upon activation of the new PAssion POSB Debit Card.

What is Mastercard contactless?

Mastercard contactless is a contactless payment method for purchases of S$200 and below at all Mastercard contactless point-of-sale readers. Simply hold your PAssion POSB Debit Card on the contactless reader to pay for your purchases.

Explore more

Thank you. Your feedback will help us serve you better.

Was this information useful?

How To Change My Posb Atm Card To Debit Card

Source: https://www.posb.com.sg/personal/cards/debit-cards/passion-posb-debit-card

Posted by: costadereddeedly.blogspot.com

0 Response to "How To Change My Posb Atm Card To Debit Card"

Post a Comment